By Priscilla Anand, Vice President / GIS Technical Manager

Mapping Tool Helps Protects Servicers and Homeowners Alike

If you’ve read any of our previous blogs, you’ve probably picked up on a common theme: tax servicers need to be extremely diligent setting up tax lines. Miss a parcel or a taxing agency and down the line a homeowner’s property could be in jeopardy. At the very least, the borrower’s relationship with the servicer and the servicer’s relationship with the GSEs may be damaged. For example, Fannie Mae specifically states:

“Without regard to whether the mortgage loan has an escrow account, the servicer must protect Fannie Mae’s mortgage lien and the property securing the mortgage loan by…monitoring the status of all escrow and related charges, which may include but are not limited to …any other charges, fines, and imposition attributable to the property which can attain priority over Fannie Mae’s mortgage lien.”

Often, it’s lower or specialty liens that cause problems. These liens cover special assessments for infrastructure, road maintenance, libraries, police, fire and water authorities among many others. Some of these are relatively easy for servicers to discover as they are “ad valorem” (based on property value). Non-ad valorem assessments (e.g., irrigation, drainage, solid waste/sewer, property improvement districts, etc.) are much more difficult to identify because they aren’t included in a homeowner’s main property tax. Until recently, tax service providers had to rely on their knowledge of local markets to identify which properties might be subject to lower liens.

How big is the challenge? Every 5 years, the U.S. Census Bureau conducts a “Census of Government” that counts special districts. The most recent census identifies 38,542 districts. Unfortunately, there is no indication of how many of these can take a lien position that is superior to a mortgage lien if unpaid. LERETA’s last active agency count was a little over 24,000. That’s why LERETA is continuously monitoring and adding boundaries to support identification of these liens.

LERETA, has been using geographic information services (GIS) technology to identify these hidden risks. GIS provides an intersection of data analysis, programming and cartography through mapping software and the design of digital maps using geographic data and multiple data sets. Most of us in the industry understand how GIS is used in determining flood zone designation and several other sectors. However, what’s new is how LERETA is now leveraging this same tool more than ever to help protect both servicers and homeowners against the possibility that a property could be “at risk” because of an undisclosed lower lien or specialty tax encumbrance.

Sometimes referred to as “geospatial mapping,” GIS can overlay the boundaries of a local water district, for example, with existing parcel maps to instantly identify all properties that are impacted by the special assessment. This automated, seamless analysis can significantly reduce exposure for all parties.

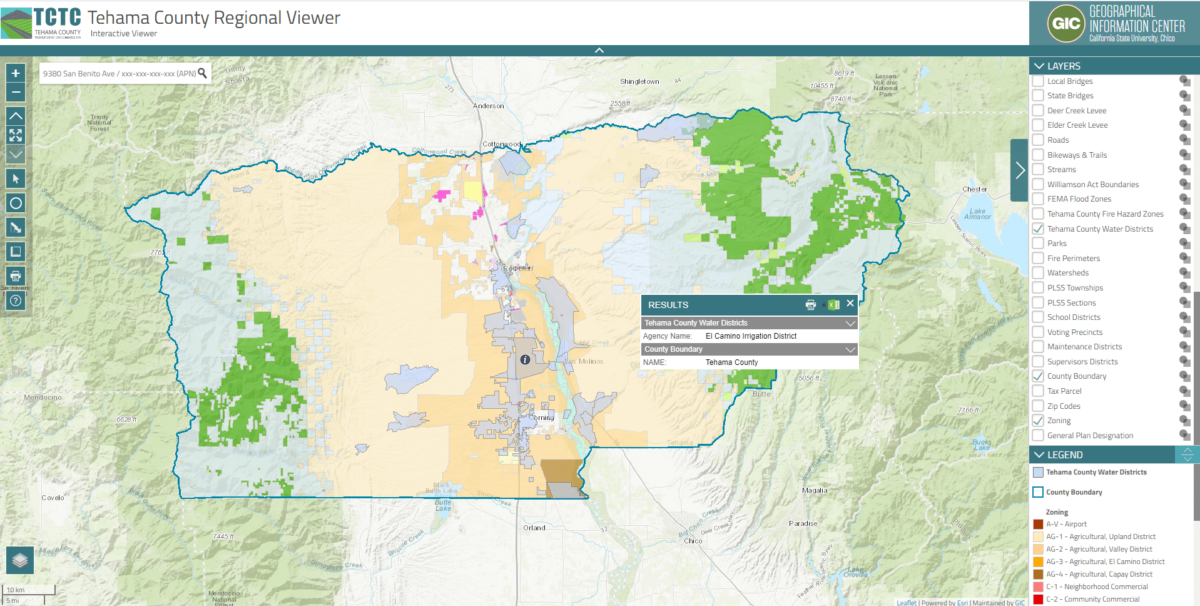

For example, using GIS technology, LERETA can take a county such as Tehama County, which is part of the California micropolitan statistical area (MSA) and create a spatial intersected map which can be digitized for automated property tagging that can show if additional tax affects the property.

The map indicates there are various potential Water districts within the county which may represent additional assessments which must be paid by the homeowner. What can make it even more difficult is that a property may reside inside a boundary but not be subject to the additional encumbrance. For example, not all properties in a water district boundary are serviced. LERETA takes it to the next level and verifies that the property is indeed impacted (or not) by the encumbrance.

While almost all tax servicers are good about paying insurance and straightforward property tax bills, mistakes can happen when a tax district doesn’t have an electronic assessment or billing data available to notify the servicer/borrowers. This can lead homeowners to simply not pay attention to a special assessment thinking “oh, this is probably included in my regular property tax bill” and they either file it or, more likely, trash it. Given that taxing and special district jurisdictions don’t have a standard countrywide template for how to communicate their tax and other assessment bills to homeowners or tax servicers you have the makings for confusion and workarounds which are almost all manual and time-consuming, and, as stated earlier, a silent risk to lien position.

Once LERETA has confirmed the lower lien, the parcel can be tagged with an alert notifying the servicer of any delinquencies, regardless of whether an escrow account is set up. For those homeowners with escrow accounts a separate escrow account is set up so that the servicer knows the amount necessary to cover the tax or assessment, when it is due and notify and bill the homeowner accurately.

To get more information about how LERETA can help servicers avoid lower lien tax risk using GIS technology, contact us at sales@lereta.com

At LERETA, we care about the details.